A real estate bubble, also known as a housing bubble, is a rapid rise in property prices caused by high demand and reduced supply for houses. Investors usually take advantage of such times and pour a lot of money into the market if they anticipate there are high chances of future price increase, driving demand even higher. Higher prices will lead to excess supply, resulting in demand falls and price declines, and the real estate bubble eventually bursts.

Real estate bubbles have a major impact on people of all classes, neighborhoods, and the economy as a whole. They can compel people to look for alternatives to pay off their house loans through various programs or even force them to dip into their retirement assets in order to afford their homes.

With real estate values reaching higher it appears that everyone looking to invest in real estate, and hopeful home owners, is wondering if the home market will crash once more. While no one can predict what will happen, looking at real estate market indicators can help us figure out where we are in the natural economic cycles of recovery. A bursting of the housing bubble is unlikely to happen, and here are some reasons why.

Credit-worthy borrowers

Housing prices are rapidly rising, but this is not the same as the subprime mortgage disaster. The majority of loans are going to people with good credit and large down payments. Mortgage loan availability is reaching its lowest point since 2014, meaning that banks are holding back on lending, or households are holding back on loans because they are concerned about the pandemic’s fallout on their finances.

Housing supply

The current supply of houses in the market is as low as it’s ever been, just like in the late 1990s. However, the cause isn’t necessarily a mass of hungry homebuyers but rather the pandemic and the related work-from-home options. There are also fewer homes on the market due to many homeowners’ apprehensions about allowing strangers into their homes while an airborne sickness spreads over the world.

Homebuilders also reduced the number of homes they built due to the lingering effects of the previous housing bubble, recession, and supply availability. Since peaking in 2006, building permits and house sales have decreased by 26% and 37%, respectively.

Better balance sheets

Another reason this isn’t like the subprime crisis is the situation of consumer finances in the United States. The consumer in the United States is in better shape than they’ve ever been coming out of recession, thanks to decreasing interest rates, some hesitation from the last crash, and a big dose of stimulus payments. Homeowners also have far more equity in their homes.

There was more than $10 trillion in home equity by the end of 2007 and more than $9 trillion individuals in loans. There is now over $21 trillion in home equity and $10 trillion in debt in the United States. During the previous real estate bubble, the credit scores of most US buyers were marginal at best, and they took loans they couldn’t possibly repay, which is not the case this time around.

Economy

The status quo of the economy is another aspect that greatly affects the real estate market. Economic metrics, for instance, the GDP, employment data, among others, are used for assessment. In a nutshell, if the economy is slow, the real estate market will also be adversely affected, and when it is high, then the real estate market will also outperform. The money supply is crucial to an economy’s general health and, in particular, to the housing market. Housing starts, and sales may drop if borrowing money becomes too tough.

If money is too easy to get, a large number of people will enter the home market, driving up prices for a period until the eventual market correction, if not crash, takes place. Housing development and sales markets should, in theory, be in sync with economic activity. With the increase in overall economic activity and prosperity, consumers will have a more disposable income and encourage homeownership.

Interest Rates

The real estate bubbles are also significantly impacted by the interest rates on loans. Before you buy a house or a property at apartmentguide.com, ensure you understand the interest rates that come with that particular mortgage. Interest rate instabilities can affect the person’s capacity to buy a good home. With the interest rates on mortgages decreasing, the cost of obtaining the mortgage has also decreased, leading to a higher demand for real estate, which has in turn led to an increase in prices.

Government Policies

Another element that could have an impact on the Real Estate Bubble is the policies imposed by the government. Some of the government’s methods to temporarily increase demand in the real estate industry are introducing taxes, deductions, and subsidies. Keeping up with the current government incentives will help people determine any changes detected in the supply and demand in the real estate market.

In an attempt to jump-start home sales in a slow economy, the US government came up with a strategy for credit to homeowners in 2009. Approximately 2.3 million took advantage of this strategy, but it was just a temporary one.

Demographics

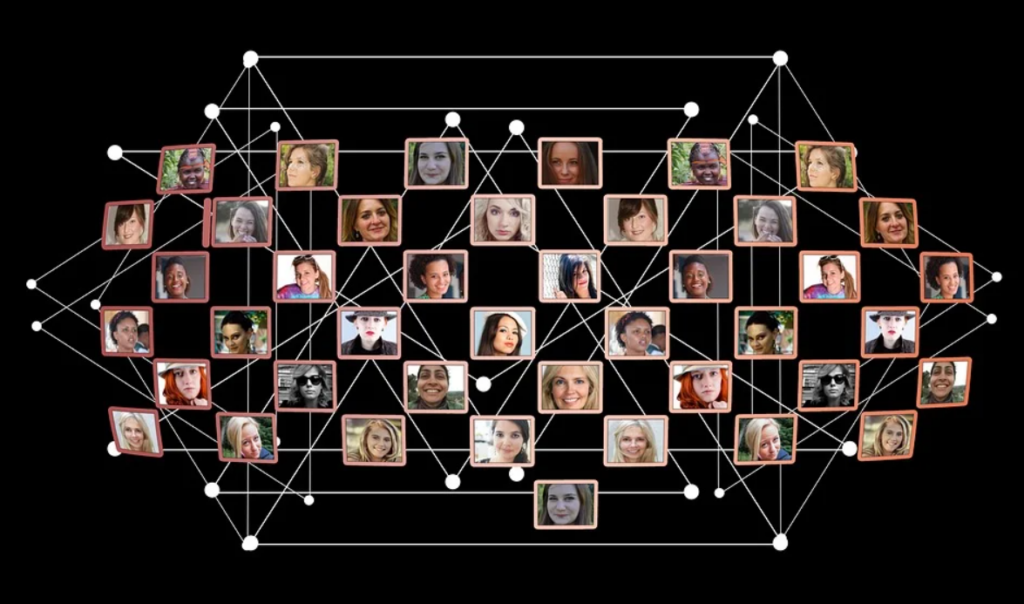

Demographic refers to age, ethnicity, gender, income, migration trends, and population growth. This fact is often overlooked, but it’s an essential one in determining the value of the real estate industry. Any slight change in the demography can have a long-term outcome on the real estate patterns.

Individuals born in the years 1945 and 1964 are excellent examples of the demographic group that will greatly impact the real estate market. Individuals in this age group will be one of the most capturing demographic of available homes and investment properties which began back in 2010.

An assessment of the housing market and the property prices shows that a real estate bubble pop is not likely to occur anytime soon. People are not getting bad loans and the interest rates on such loans have remained quite low. Moreover, the government has also set measures to cushion people from the impacts of the pandemic on the economy.